5 Best Books to Understand the Banking System and Financial World

Banks play a crucial role in our daily lives by providing financial services that help us manage money, buy homes and cars, and invest for the future. Despite their importance, many people don’t fully understand how banks operate, how they make money, or how their decisions impact the global economy. To help you gain a deeper understanding, we have compiled a list of the 5 best books on how banks work. These books provide clear explanations, real-life examples, and insights into the inner workings of banks, central banks, and the financial system. Whether you are a finance student, professional, or curious reader, these books will help you grasp the complexities of the financial world.

1. The Greed Merchants by Philip Augar

Philip Augar’s The Greed Merchants provides an honest and detailed look at the conflicts of interest in commercial and investment banking. The book explores unethical practices used by bankers to maximize profits and how these behaviors affect companies and economies worldwide.

This book highlights how investment bankers exploit insider knowledge, overcompensate themselves, and prioritize bonuses over ethical considerations. Augar supports his claims with real events and evidence, making this a compelling read for anyone seeking to understand the darker side of banking.

2. The House of Morgan by Ron Chernow

The House of Morgan traces the history of the Morgan financial dynasty across four generations, illustrating both its achievements and failures. Chernow explores the bank’s influence on global finance and its reputation as a powerful, untouchable institution.

The book delves into key historical events, including mergers, leveraged buyouts, and financial crises, showing how greed and ambition shaped the industry. It also offers lessons on ethical banking and the need for reform, making it essential reading for those interested in the evolution of finance and banking history.

3. The End of Banking by Jonathan McMillan

Jonathan McMillan argues that the modern banking system is often unsustainable and flawed. The End of Banking critiques the current structure while offering a vision for a more democratic and resilient financial system.

The book provides clear explanations of financial crises, the role of banks, and why these crises tend to repeat. McMillan’s evidence-backed insights help readers understand how banking policies affect the economy and society, making this book ideal for those seeking a thoughtful perspective on reforming financial systems.

4. How the Other Half Banks by Mehrsa Baradaran

How the Other Half Banks explores financial exclusion in the United States and proposes public banking options to include under-served populations. Baradaran examines the historical and systemic reasons why millions remain outside the traditional banking system.

The book provides practical solutions for bridging the gap, reducing reliance on predatory lenders, and promoting financial inclusion. It is a must-read for anyone interested in social impact, equitable finance, and policies to reduce wealth inequality.

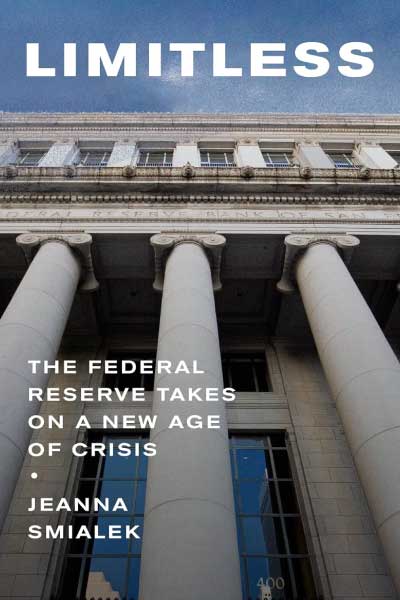

5. Limitless: The Federal Reserve Takes on a New Age of Crisis by Jeanna Smialek

Jeanna Smialek’s Limitless offers an engaging account of the Federal Reserve’s role in managing crises and shaping the U.S. economy. The book explains how Fed decisions on interest rates, monetary policy, and crisis management affect everyday life and global financial stability.

Smialek brings historical events and key policymakers to life, showing readers the challenges and responsibilities of central banking. This book is perfect for anyone looking to understand the influence of the Federal Reserve on both the national and global economy.

Final Thoughts

Banks are at the heart of our financial system, but their inner workings often remain a mystery. The five books listed above provide clear explanations, real-world examples, and expert insights into how banks operate, how they earn profits, and how financial crises happen.

Whether you are a finance student, professional, or curious reader, these books will help you:

- Understand the role of banks and central banks in the economy

- Learn about investment banking and ethical challenges

- Explore policies for financial inclusion and sustainability

- Gain insights into global monetary policy and the Federal Reserve

By reading these books, you can unlock the secrets of the banking world, make informed financial decisions, and develop a deeper understanding of the forces shaping the global economy.